The Close

Knocking on the door of 6,000.

The S&P 500 (GSPC) surged 1.0% to close at 5,996.66, finishing just three points shy of the historic 6,000 milestone. It was the index's best week in two months (+2.9%), driven by a potent combination of cooling macro data and idiosyncratic corporate catalysts. The Nasdaq Composite (IXIC) led the charge, gaining 1.5% to 19,630.20, while the Dow Jones Industrial Average (DJI) added 0.8% to close at 43,487.83.

Session Recap

Markets opened with a risk-on tone following December Retail Sales data, which rose 0.4% against a 0.7% estimate. Traders interpreted the miss as a "Goldilocks" signal—soft enough to keep the Fed on a cutting path, but strong enough to ward off recession fears. Treasury yields stabilized, with the 10-Year Yield (TNX) dipping 1 basis point to 4.61%, providing a green light for valuation expansion.

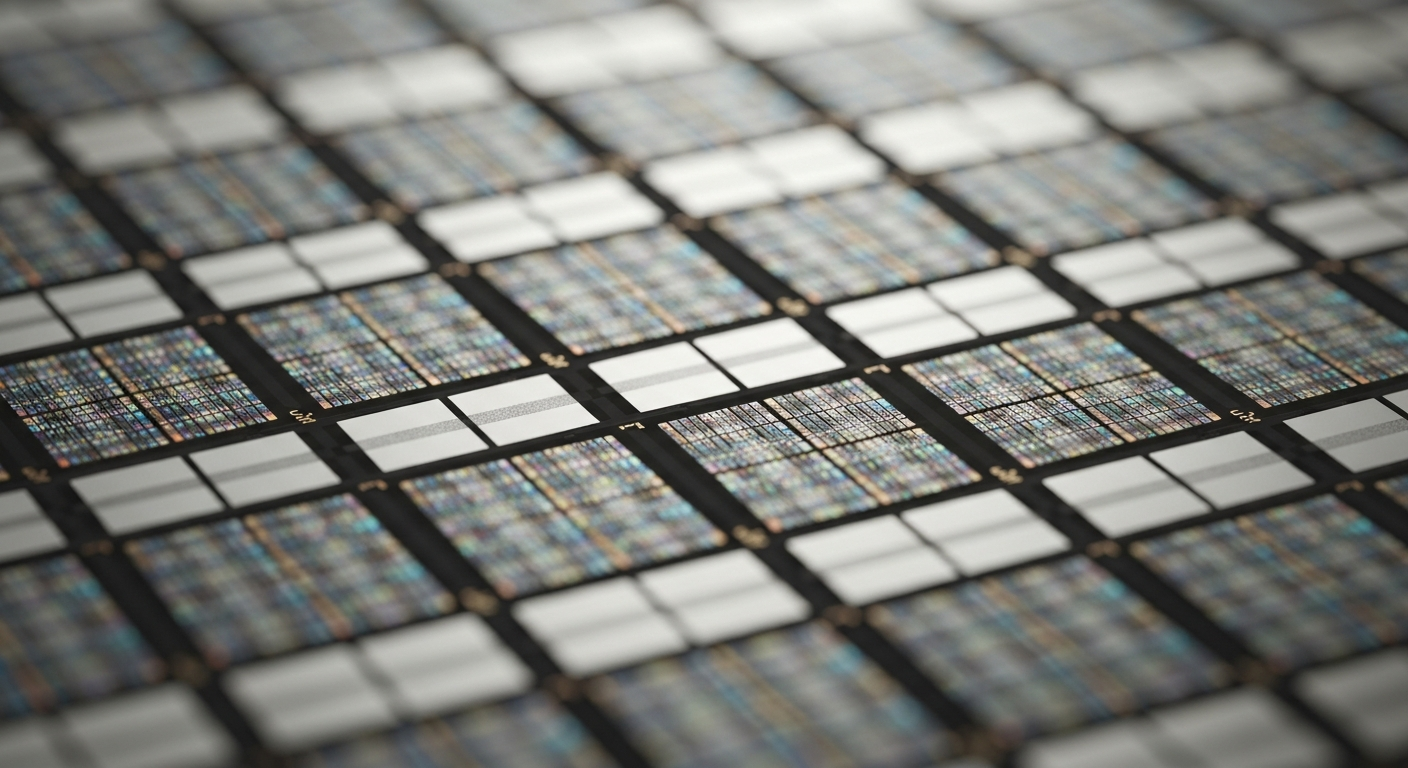

Momentum accelerated mid-day as M&A rumors swirled around legacy tech, specifically Intel ($INTC), and energy earnings from Schlumberger ($SLB) surprised to the upside. Buying pressure remained consistent into the final hour, though the S&P 500 ultimately stalled mere points from the 6,000 level, suggesting some psychological resistance ahead of the long holiday weekend.

Movers

Top Gainers

Under The Hood

While large caps dominated, the Russell 2000 (RUT) lagged slightly, rising just 0.4% to 2,275.88. This divergence suggests investors preferred the safety of high-quality balance sheets and mega-cap liquidity over small-cap exposure heading into the three-day weekend.

Sector Scorecard

Growth and Energy led the session, a rare dual-leadership dynamic driven by specific earnings and macro relief.

- Best: Technology (XLK) and Consumer Discretionary (XLY) outperformed on the back of NVIDIA ($NVDA) and Tesla ($TSLA) strength (+3.1% each).

- Notable: Energy (XLE) found support from Schlumberger ($SLB), bucking recent weakness despite mixed crude action.

- Financials: Regional banks showed strength, led by Truist ($TFC), as earnings season kicked off with better-than-feared results.

Weekend Watch

With U.S. equity markets closed Monday for Martin Luther King Jr. Day, the focus shifts entirely to the crypto markets. Bitcoin has surged to ~$105,900, its highest level in a month, ahead of the presidential inauguration. Traders will be watching if the $105k level holds as support over the long weekend, which could set the tone for risk assets when futures reopen Tuesday evening.

Tuesday's Calendar

Markets are closed Monday (Jan 20) for MLK Day. Trading resumes Tuesday.

- Events: Presidential Inauguration (Monday); Earnings season accelerates Tuesday.

- Earnings: Major financials and regional banks continue to report.

- Data: Light economic calendar to start the shortened week.

Disclaimer: This content is for informational and educational purposes only and does not constitute financial advice, investment advice, or any other type of advice. Past performance is not indicative of future results. All investments involve risk, including the potential loss of principal. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.