The Weekend Review

The bond market is casting a vote on the Fed Chair, and it's not the one equity bulls wanted.

Taiwan Semiconductor ($TSM) delivered the fundamental news the market craved earlier this week—a massive capex hike to $52-56 billion—but rising Treasury yields spoiled the celebration by Friday's close. The 10-year yield pushed to a 4-month high of 4.23%, acting as a gravity well for valuation multiples. While the S&P 500 (GSPC) finished the week flat (-0.06% on Friday), the underlying tension is palpable: corporate earnings are accelerating, but the cost of capital is rising to meet them.

Market Action

U.S. markets closed a volatile week on a mixed note. The Nasdaq Composite (IXIC) dipped 0.06% to 23,515, unable to hold early gains despite strength in the semiconductor complex where Micron ($MU) and Super Micro ($SMCI) rallied on the TSM capex tailwinds. The Dow Jones Industrial Average (DJI) lagged, falling 0.17% to 49,359. The standout remains the Russell 2000 (RUT), which bucked the trend to hit a fresh record high (+0.1%), signaling a rotation into domestic cyclicals. In commodities, WTI Crude Oil climbed 0.4% to $59.40, while Gold retreated 0.6% to $4,595 as real rates rose.

What We're Watching

The "Warsh Premium" in Bonds

Traders are aggressively repricing the Treasury curve based on speculation that President Trump favors Kevin Warsh over Kevin Hassett for Fed Chair. Warsh is viewed as the hawkish option—a skeptic of QE and a proponent of sound money.

- Key Level: 4.25% on the 10-Year Treasury yield. A breakout here opens the door to 4.35%.

- Upside: If Warsh is confirmed, expect the curve to bear-flatten as long-end yields rise on tighter policy expectations.

- Downside: A pivot back to Hassett (viewed as more dovish/pro-growth) could see yields retreat to 4.10%.

- Invalidates If: The administration signals a compromise candidate, diffusing the binary risk.

Top Stories

Earnings power, personnel policy, and housing headwinds defined the week's narrative.

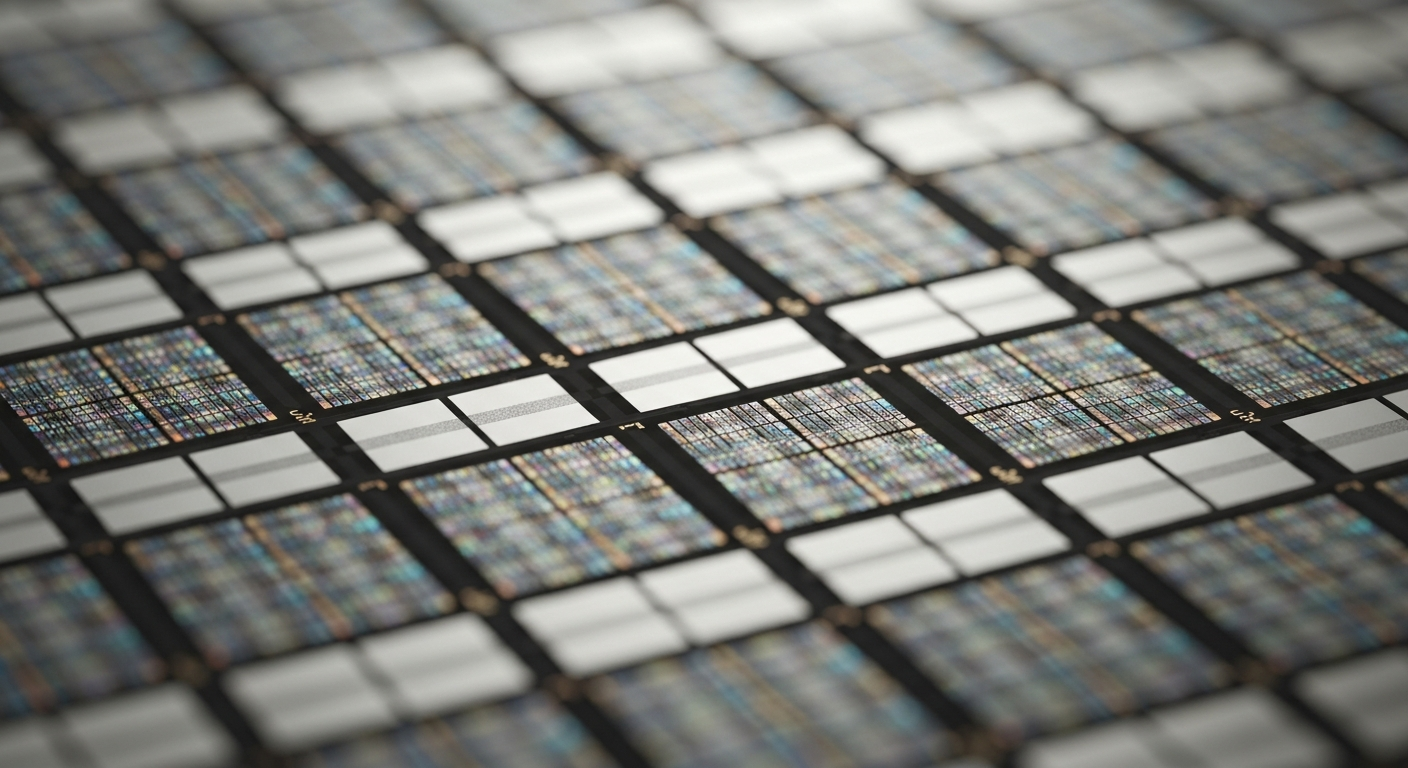

TSMC Capex Plan Confirms AI Supercycle

Taiwan Semiconductor ($TSM) set the tone Thursday with blowout earnings and plans to increase U.S. capital spending to between $52 billion and $56 billion. While TSM shares consolidated Friday (+0.8%), the massive commitment validated the structural demand for advanced packaging and AI logic chips.

Why It Matters: This is the "picks and shovels" signal the market needed. It confirms that hyperscaler demand is translating into physical infrastructure buildouts.

Market Impact: Super Micro Computer ($SMCI) jumped 10.94% and Micron ($MU) rallied 7.76% on Friday as the downstream beneficiaries of this spend.

Housing Sentiment Collapses as Rates Bite

The NAHB Housing Market Index plummeted to 37, missing expectations and signaling deep pessimism among homebuilders. With the 10-year yield back above 4.20%, mortgage rates are likely pressuring demand again, stalling the recovery in the physical economy.

Why It Matters: It highlights the bifurcation of the economy: the AI sector is booming while interest-rate-sensitive sectors are rolling over.

Context: This data conflicted with the Empire State Manufacturing survey, which surprised to the upside (7.7 vs 0.8 est), suggesting regional manufacturing resilience.

Weight Loss Wins: Novo Nordisk Rallies

Novo Nordisk ($NVO) advanced 8.95% following a key regulatory win for Wegovy in the U.K. The approval expands the addressable market for GLP-1 drugs, reinforcing the duopoly narrative in the obesity space.

Why It Matters: Regulatory moats are deepening for the incumbents, making it harder for new entrants to capture share without significant clinical data.

Next Catalyst: Upcoming prescription volume data to see if supply can meet the expanded approved demographic.

Positioning

Flows: Capital is rotating aggressively into small caps and financials. The Russell 2000 hitting a record high while the Nasdaq stalls suggests a "catch-up" trade is in play, aided by Morgan Stanley ($MS) rising 5.8% and PNC Financial ($PNC) rising 3.8% on strong dealmaking fees reported Thursday.

Sentiment: The VIX (VIX) dropped 5.43% to 15.84 despite the rise in yields. This divergence—falling fear gauge amidst rising cost of capital—suggests equity investors are complacent about the rate threat, betting that earnings growth will outpace multiple compression.

Week Ahead

- Monday: Markets Closed (Martin Luther King Jr. Day).

- Earnings Focus: After Goldman Sachs ($GS) lagged (-1%) and Morgan Stanley ($MS) surged (+5.8%) last week, focus turns to regional banks and tech earnings to confirm the rotation thesis.

- Fed Speakers: Quiet period remains in effect ahead of the upcoming FOMC meeting.

Risk Watch

The 4.30% Yield Breaker

The primary risk to the equity rally is the velocity of the move in Treasuries. If the 10-year yield breaches 4.30% rapidly, it could trigger algorithmic selling in risk-parity funds and pressure the high-valuation tech cohort. The correlation between stocks and bonds is flipping positive again, meaning a bond sell-off could drag equities down with it. Watch the 4.25% level closely next week.

Disclaimer: This content is for informational and educational purposes only and does not constitute financial advice, investment advice, or any other type of advice. Past performance is not indicative of future results. All investments involve risk, including the potential loss of principal. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.